In the realm of finance, understanding the concept of compound interest is akin to discovering a powerful tool that can significantly influence one’s financial future. Compound interest, often described as “interest on interest,” is the process by which a sum of money grows exponentially over time, thanks to the interest earned on both the initial principal and the accumulated interest from previous periods. This mechanism stands in contrast to simple interest, where interest is calculated solely on the principal amount, without taking into account the interest that accumulates over time.

The principle of compound interest is not only a fundamental concept in personal finance but also a critical element in the fields of banking, investment, and economics. Its ability to amplify wealth over time has been a cornerstone in the strategy of savers and investors alike. Whether it’s a savings account, a retirement fund, or a loan, the effects of compound interest are ubiquitous, influencing decisions and outcomes across a spectrum of financial activities.

By diving into the mechanics of compound interest, individuals can unlock the potential to make more informed decisions about saving, investing, and borrowing. This article aims to demystify the concept of compound interest, exploring its mathematical foundation, practical applications, and the profound impact it can have on financial planning and wealth accumulation.

What is Compound Interest?

Compound interest is a financial principle that describes the process by which an initial sum of money grows over time, thanks to the interest that accumulates not only on the original amount but also on the interest that has been previously added to the sum. This concept is distinct from simple interest, where interest is generated solely on the principal amount, without considering the accumulation of past interest.

At the heart of compound interest is the idea that money can earn money. When interest is compounded, each interest payment is added to the original principal, creating a new base amount on which future interest payments are calculated. As a result, the amount of interest earned accelerates over time, creating exponential growth. This is why compound interest is often referred to as “interest on interest,” and it has a profound impact on savings, investments, and loans over the long term.

Read More: Portfolio Trading: Maximizing Returns through Diversified Investments

The power of compound interest lies in its ability to exponentially increase the value of an investment or savings over time. It is a critical concept for anyone looking to build wealth or manage debt effectively. Through compounding, even small, regular contributions to a savings account or investment can grow into substantial sums over the years, highlighting the importance of starting early and letting time work in your favor.

Understanding compound interest is essential for making informed financial decisions. Whether you are saving for retirement, investing in the stock market, or taking out a loan, the principles of compound interest will play a crucial role in determining the outcome of your financial endeavors. By grasping how compound interest works, individuals can plan better for their future, maximizing their potential for financial growth and security.

The Power of Starting Early

One of the most compelling aspects of compound interest is its ability to transform modest savings into substantial wealth over time. The key to unlocking this potential is starting early. The earlier an individual begins to save or invest, the more time compound interest has to work its magic, exponentially increasing the value of those savings.

The Impact of Time

The impact of time on compound interest can be illustrated through a simple comparison. Consider two individuals, Alex and Jordan. Alex starts saving $100 a month in an investment account with an annual return of 5%, compounded monthly, at age 25. Jordan starts the same saving strategy, but at age 35. By the time both reach the age of 65, Alex’s investment will have grown significantly more than Jordan’s, despite the fact that they both saved the same amount monthly and received the same annual return. This difference is solely due to the additional ten years that Alex’s savings had to compound.

Compound Interest and Retirement Savings

The principle of starting early is particularly crucial when it comes to retirement savings. Due to the power of compound interest, small, regular contributions to a retirement account made in one’s 20s or 30s can grow to be worth more than larger contributions made at a later age. This is why financial advisors often stress the importance of contributing to retirement accounts as early as possible.

Tips for Maximizing Compound Interest

- Start Now: Even if you can only save a small amount, the act of starting makes a significant difference over the long term.

- Regular Contributions: Consistently adding to your savings or investment accounts not only builds the habit of saving but also continually increases the base amount earning interest.

- Increase Savings Over Time: As your income grows, aim to increase the amount you save or invest. Even modest increases can significantly impact due to compound interest.

The power of starting early with compound interest cannot be overstated. It is a simple yet profoundly effective strategy for building wealth over time. By understanding and applying this principle, individuals can significantly enhance their financial security and future prospects.

The Mathematics of Compound Interest

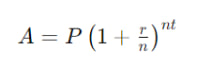

The formula for calculating compound interest is a testament to the power of exponential growth in finance. Expressed mathematically, the formula is:

The formula for calculating compound interest is a testament to the power of exponential growth in finance. Expressed mathematically, the formula is:

Where:

Where:

- A represents the future value of the investment/loan, including interest.

- P is the principal amount (the initial amount of money).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the time the money is invested or borrowed for, in years.

This formula encapsulates the essence of compound interest by showing how the principal amount grows over time, not just through the accumulation of interest on the original amount, but also through the accumulation of interest on top of interest. This is what distinguishes compound interest from simple interest, where the calculation is linear and only based on the principal amount.

Breaking Down the Formula

- Principal (P): The starting point of the investment or loan, serving as the base for the interest calculations.

- Rate (r): The percentage of the principal that is paid in interest once per period (e.g., annually). It is expressed as a decimal in the formula, meaning a 5% interest rate is written as 0.05.

- Time (t): The duration for which the money is invested or borrowed. The longer the time, the greater the compound interest effect.

- Frequency of Compounding (n): This reflects how often the interest is calculated and added to the principal. Common frequencies include yearly, quarterly, monthly, or daily. The more frequently interest is compounded, the more interest is accrued over the same time period.

Example Calculations

To illustrate, consider an investment of $1,000 at an annual interest rate of 5% compounded annually for 5 years. Using the formula:

This example shows that the investment will grow to $1276.28 after 5 years, with the compound interest mechanism contributing significantly to the increase in value over the initial principal.

The magic of compound interest becomes even more apparent with more frequent compounding intervals. For instance, if the same investment compounded quarterly, the future value would be slightly higher, demonstrating how the frequency of compounding can impact the growth of an investment.

Understanding these components and their interplay is crucial for anyone looking to make informed decisions about investments, savings, or loans. It highlights the importance of considering not just the rate of interest, but also the frequency of compounding and the time horizon of an investment.

Practical Applications of Compound Interest

Compound interest plays a pivotal role in the financial world, influencing a wide range of products and decisions. Understanding its applications can help individuals maximize their financial growth and make strategic choices about saving, investing, and borrowing.

Compound interest plays a pivotal role in the financial world, influencing a wide range of products and decisions. Understanding its applications can help individuals maximize their financial growth and make strategic choices about saving, investing, and borrowing.

Savings Accounts

One of the most straightforward applications of compound interest is in savings accounts. Banks offer interest on the deposits held in these accounts, which is compounded over time, allowing the balance to grow faster than it would with simple interest. The frequency of compounding can vary, with some banks offering daily, monthly, or quarterly compounding, affecting how quickly the account balance increases.

Read Next: Trading Manual: A Comprehensive Guide to Financial Markets

Investment Products

- Retirement Accounts (401(k)s, IRAs): Compound interest is the driving force behind the growth of retirement savings. Contributions made to these accounts grow over time, benefiting from the compound interest effect, which can significantly increase the value of the retirement fund by the time of withdrawal.

- Stocks and Mutual Funds: While not directly applying compound interest, the concept of reinvesting dividends and earnings allows investors to benefit from a similar compounding effect, as returns are reinvested to generate their own returns.

Loans and Mortgages

In the context of loans and mortgages, compound interest works in favor of the lender. It’s applied to the outstanding balance of a loan, meaning that borrowers pay interest not only on the principal amount but also on the accumulated interest over time if not paid off. Understanding how compound interest works can help borrowers plan their finances better and choose loan terms that minimize the total amount paid over time.

Compound Interest’s Impact on Debt

Credit cards are a common example where compound interest can have a negative impact on consumers. If the balance is not fully paid off each month, interest is charged on the new balance, which includes the previous month’s interest. This can lead to rapidly escalating debt if not managed carefully.

Maximizing the Benefits of Compound Interest

Start Early: The power of compound interest is maximized over time. Starting to save or invest early can lead to significantly larger gains due to the compound interest effect.

Start Early: The power of compound interest is maximized over time. Starting to save or invest early can lead to significantly larger gains due to the compound interest effect.- Regular Contributions: Regularly adding to savings or investment accounts can further enhance the compounding effect, as each contribution itself starts earning interest.

- Choosing the Right Frequency of Compounding: Opting for accounts or investments that offer more frequent compounding can result in higher returns over the same period.

The practical applications of compound interest underscore its importance in both growing wealth and managing debt. By leveraging the principles of compound interest in saving and investing strategies, individuals can significantly enhance their financial well-being.

Conclusion

Compound interest, often hailed as the eighth wonder of the world, is a fundamental concept in finance that has the power to transform one’s financial landscape. Its principle—that earnings can generate their own earnings—underscores a powerful mechanism that can significantly amplify wealth over time or, conversely, exacerbate debt.

Throughout this article, we’ve explored the mathematical underpinnings of compound interest, revealing how the formula

A=P(1+r/n) nt

serves as the cornerstone for understanding how investments grow. We delved into the practical applications of compound interest, from savings accounts and retirement funds to loans and mortgages, illustrating its ubiquitous influence in financial products and decisions.

The historical journey of compound interest, from its ancient origins to its role in modern financial systems, highlights its enduring relevance. Meanwhile, practical advice on leveraging compound interest—such as starting early, making regular contributions, and choosing investments with favorable compounding terms—provides actionable strategies for individuals looking to harness its power.

Yet, as with all powerful tools, compound interest comes with considerations. The impact of factors like inflation, tax implications, and the risk associated with various investment vehicles must be carefully weighed. Understanding these elements is crucial for making informed decisions that align with one’s financial goals and risk tolerance.

In conclusion, compound interest is not just a mathematical curiosity; it is a critical concept in personal finance. Whether saving for retirement, investing in the stock market, or managing loans, the principles of compound interest are at play, influencing outcomes in profound ways. By demystifying its complexities and understanding its applications, individuals can better navigate the financial landscape, making decisions that propel them toward financial security and growth. In essence, a deep understanding of compound interest is a cornerstone of savvy financial planning and wealth accumulation.

The journey of financial education is ongoing, and mastering the concept of compound interest is a crucial step in that journey. By embracing the principles outlined in this article, readers can set themselves on a path to financial literacy and independence, empowered by the knowledge of how to make their money work harder for them.