Private security transactions play a pivotal role in capital markets, particularly for startups, privately held companies, and alternative investment funds. Unlike public securities traded on exchanges such as the NYSE or NASDAQ, private securities are bought and sold outside public markets, usually between private investors and issuers. These transactions offer greater flexibility and fewer regulatory hurdles—but also carry higher risks and lower liquidity.

Whether you’re an entrepreneur seeking funding, an investor looking for high-growth opportunities, or a finance professional managing alternative assets, understanding how private security transactions work is essential. This article provides a comprehensive breakdown of private securities: what they are, how they’re structured, who they’re for, and what risks and rewards they bring.

What Are Private Security Transactions?

Private security transactions refer to the buying or selling of equity or debt securities that are not registered with the Securities and Exchange Commission (SEC) for public trading. These securities are typically issued through private placements or negotiated directly between issuers and investors.

Private security transactions refer to the buying or selling of equity or debt securities that are not registered with the Securities and Exchange Commission (SEC) for public trading. These securities are typically issued through private placements or negotiated directly between issuers and investors.

Common examples include:

- Shares in privately held startups

- Convertible notes and SAFE (Simple Agreement for Future Equity) agreements

- Private debt offerings and promissory notes

- Interests in private equity or hedge funds

- Real estate investment syndicates or crowdfunding offerings

Read More: 10 Online Trading Platforms in 2024

Key Characteristics

Most defining features of private security transactions, offering insight into how they differ from public market investments. These characteristics impact who can participate, how deals are structured, and what kind of risks and opportunities they present to both issuers and investors.

1. Limited Access

Private securities are generally restricted to “accredited investors”—individuals or institutions that meet specific income or net worth thresholds. This limits access to a small, well-qualified investor pool.

2. Regulatory Exemptions

Issuers can offer private securities without registering with the SEC, usually by relying on exemptions like Regulation D or Rule 144A. These rules lower the cost and complexity of issuing capital, but also reduce investor protections.

3. Reduced Transparency

Unlike public companies, issuers of private securities are not required to publish audited financials or ongoing disclosures. Investors rely heavily on due diligence and private reports.

4. Illiquidity

There is typically no active secondary market for private securities, which means investors often must hold the asset for years before seeing returns—typically through acquisition, IPO, or liquidation events.

Legal and Regulatory Framework

Understanding the legal and regulatory foundation for private security transactions is essential for both issuers and investors. These frameworks determine how securities can be lawfully offered, sold, and resold without requiring full SEC registration.

Understanding the legal and regulatory foundation for private security transactions is essential for both issuers and investors. These frameworks determine how securities can be lawfully offered, sold, and resold without requiring full SEC registration.

By navigating exemptions such as Regulation D, Rule 144A, and Regulation A+, companies can efficiently raise capital while remaining compliant with federal securities laws. Investors, in turn, can assess the level of oversight and risk involved in each type of transaction.

Regulation D

Regulation D is the most commonly used exemption for private placements, primarily because it allows issuers to raise capital without undergoing the extensive and costly process of registering with the SEC. This exemption is especially attractive to startups and small to midsize businesses looking to avoid the time and expense of a public offering. Regulation D offers flexibility in how and from whom funds are raised, particularly through Rule 506(b) and Rule 506(c).

Issuers often prefer Regulation D because it permits them to tailor offerings to specific investor profiles. For instance, under Rule 506(b), companies can include up to 35 non-accredited investors while still raising unlimited capital. This makes it possible to bring in early supporters, friends, and family, along with institutional backers. Rule 506(c), on the other hand, enables public advertising of the offering as long as all investors are verified as accredited, expanding the reach of the issuer’s fundraising efforts.

Real-world examples include early-stage tech companies that use Rule 506(b) to secure seed or Series A capital from a combination of angel investors and venture funds. Similarly, real estate syndicators commonly rely on Rule 506(c) to promote investment opportunities online to a broader pool of qualified investors. These mechanisms have helped fuel the rapid growth of venture capital and private real estate markets by streamlining the fundraising process and allowing for creative, investor-friendly deal structures. (Rules 504, 506b, and 506c) Regulation D is the most commonly used exemption for private placements. Rule 506(b) allows issuers to raise unlimited capital from up to 35 non-accredited investors and an unlimited number of accredited investors. Rule 506(c) permits general solicitation, but all buyers must be accredited.

Rule 144A

This rule enables resale of restricted securities to Qualified Institutional Buyers (QIBs), providing liquidity among large financial entities.

Regulation A+

Sometimes referred to as a “mini IPO,” this exemption allows issuers to raise up to $75 million from retail investors, though it requires a lighter version of SEC filing.

Common Types of Private Securities

Various categories of private securities that are typically offered in private markets. Each type plays a unique role in capital formation and investment strategy, catering to different issuer needs and investor risk profiles. Understanding the distinctions among these instruments helps investors assess suitability and structure diversified portfolios.

1. Equity Securities

Ownership interests in private companies, often issued through seed, Series A, B, or later-stage venture funding rounds. These shares may be common or preferred.

2. Convertible Instruments

Convertible notes and SAFEs are hybrid instruments that initially act like loans or contracts but convert into equity during future fundraising rounds.

3. Debt Securities

Private loans or promissory notes issued to investors with set repayment terms and interest rates. Often used in real estate or mezzanine financing.

4. Fund Interests

Limited partnership units in private equity, venture capital, or hedge funds. Investors commit capital for long-term horizons (5–10 years or more).

5. Syndicated Investments

Crowdfunded securities or pooled investments in startups or real estate, often issued via platforms like AngelList or Fundrise.

Private vs. Public Securities

| Feature | Private Securities | Public Securities |

| Investor Access | Limited to accredited/QIB | Open to the general public |

| Regulatory Burden | Minimal (via exemptions) | High (full SEC registration) |

| Liquidity | Low | High |

| Transparency | Low | High |

| Cost of Capital Raising | Lower | Higher |

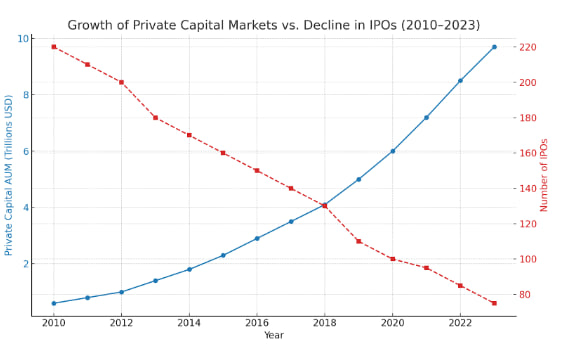

Chart: Growth of Private Capital Markets (2010–2023)

Insert chart showing rising AUM in private equity, VC, and private debt compared to shrinking number of IPOs.

Who Participates in Private Security Transactions?

Who Participates in Private Security Transactions?

Private security transactions involve a range of stakeholders, each playing a vital role in the funding and investment cycle. Understanding the motivations and typical activities of these participants provides valuable insight into how deals are structured and executed in the private market.

- Founders: These are entrepreneurs or company leaders seeking capital to launch or grow their business without undergoing the costly and time-consuming process of going public. Founders often offer equity or convertible instruments to investors in exchange for capital, while maintaining more control over the company than they might with public shareholders.

- Angel Investors: These individuals invest their personal funds into early-stage startups, typically in exchange for equity or convertible notes. Their involvement is often hands-on, as they may provide mentorship, business development support, and access to their networks in addition to funding. Their primary motivation is to earn a high return by getting in early on promising ventures.

- Venture Capital Firms: VC firms manage pooled capital from multiple investors and allocate funds to startups and high-growth companies. They typically invest in Series A and later rounds, negotiating significant ownership stakes and often taking board seats. Their goal is to realize returns through successful exits like acquisitions or IPOs.

- Private Equity Funds: These firms acquire controlling interests in mature businesses to restructure operations, improve financial performance, and eventually sell the company at a profit. PE funds often use a mix of equity and debt, and the transactions are highly structured with complex term sheets, covenants, and performance metrics.

- Family Offices and High-Net-Worth Individuals (HNWIs): These investors are drawn to private securities for their potential to generate outsized returns and diversify portfolios. Family offices may take part in both direct investments and fund-based structures, often bringing strategic connections and long-term capital.

- Institutional Investors: Entities such as pension funds, endowments, and insurance companies participate in private transactions primarily through allocations to private equity, venture capital, or hedge funds. They seek non-correlated returns, portfolio diversification, and long-term value creation, and they often demand rigorous due diligence and risk oversight before committing capital.?

- Founders seeking funding without going public

- Angel Investors funding early-stage ventures

- Venture Capital Firms targeting high-growth companies

- Private Equity Funds acquiring and restructuring businesses

- Family Offices & HNWIs seeking portfolio diversification

- Institutional Investors (endowments, pension funds) accessing non-correlated returns

Risks and Rewards

Rewards:

- Potential for outsized returns

- Access to early-stage innovation

- Customizable deal terms

- Lower competition for deals

Risks:

- High failure rate among startups

- Lock-up periods and low liquidity

- Limited information and due diligence challenges

- Legal complexity and high documentation cost

How to Evaluate a Private Security Offering

Before investing in private securities, it’s crucial to follow a rigorous evaluation process. Unlike public market investments that benefit from regulated disclosures and analyst coverage, private deals require self-directed due diligence and often involve legal complexities. Evaluating a private offering involves understanding not just the financials but also the structure, legal framework, and strategic vision of the issuing entity.

Before investing in private securities, it’s crucial to follow a rigorous evaluation process. Unlike public market investments that benefit from regulated disclosures and analyst coverage, private deals require self-directed due diligence and often involve legal complexities. Evaluating a private offering involves understanding not just the financials but also the structure, legal framework, and strategic vision of the issuing entity.

- Understand the Term Sheet: The term sheet outlines the key terms and conditions of the investment deal and serves as the foundation for more detailed legal documents. It is crucial to review clauses related to conversion terms—such as how and when debt converts into equity, and under what valuation cap or discount. Liquidation preferences define the order and priority of payouts if the company is sold or liquidated, which directly affects how much investors may recover. Voting rights determine the degree of control an investor has over company decisions, such as electing board members or approving major strategic changes. By analyzing these elements thoroughly, investors can assess the potential risks and protections associated with the investment.

- Conduct Due Diligence: Analyze financials, market opportunity, management team, and cap table. Look for red flags such as inconsistent revenue trends, high churn rates, or lack of competitive differentiation. Evaluate the company’s strategic position in its industry and whether the management team has the experience and track record to execute its business plan. A well-structured cap table with balanced equity ownership can also be a positive indicator of alignment among stakeholders.

- Assess Risk/Reward: Consider your time horizon, risk appetite, and overall portfolio strategy. Private securities are typically long-term investments that may not produce returns for years. Evaluate how the investment fits into your broader financial plan and whether you can afford the potential illiquidity. Review projections with a skeptical lens and be prepared for a range of outcomes—including total loss or delayed exits. Diversification across sectors and stages of growth can help manage portfolio risk.

- Legal Review: Always consult a securities lawyer or investment advisor before committing funds. Legal counsel can help you interpret offering documents, identify potential regulatory concerns, and assess your rights as an investor. Reviewing shareholder agreements, subscription documents, and compliance with securities exemptions is critical to avoiding disputes or unintended obligations. Professional advice ensures that your investment complies with relevant laws and aligns with your long-term interests.

Read More: Best Coding Languages for Trading Algorithms

Conclusion

Private security transactions open access to powerful funding and investing opportunities but come with unique risks and complexities. As private markets grow in popularity and sophistication, understanding the nuances of how these deals are structured, regulated, and executed will become an increasingly valuable skill.

Whether you’re looking to raise capital or invest in high-potential ventures, navigating private security transactions with care and due diligence is the key to unlocking long-term financial growth.

Looking ahead, emerging technologies such as blockchain and tokenization are poised to revolutionize how private securities are issued, traded, and managed. Tokenized securities offer the potential for increased transparency, reduced administrative friction, and enhanced liquidity through fractional ownership and automated compliance. As these innovations mature, they may lower the barriers to entry for both issuers and investors, further democratizing access to private capital markets while maintaining regulatory integrity. to powerful funding and investing opportunities but come with unique risks and complexities. As private markets grow in popularity and sophistication, understanding the nuances of how these deals are structured, regulated, and executed will become an increasingly valuable skill.

Whether you’re looking to raise capital or invest in high-potential ventures, navigating private security transactions with care and due diligence is the key to unlocking long-term financial growth.