Disclaimer: The information provided by Snap Innovations in this article is intended for general informational purposes and does not reflect the company’s opinion. It is not intended as investment advice or recommendations. Readers are strongly advised to conduct their own thorough research and consult with a qualified financial advisor before making any financial decisions.

High-Touch vs. Low-Touch: Choosing the Right Trading Strategy

In the fast-paced world of trading, selecting the right strategy can significantly impact your success. Two distinct approaches have gained prominence: high-touch and low-touch trading strategies. While both aim to maximize returns, they differ dramatically in terms of execution, human involvement, and customization. High-touch trading involves direct interaction with traders or brokers, where human expertise and personalized decision-making play a central role. This approach is favored by those who seek tailored solutions, particularly when dealing with large, complex orders or navigating volatile markets. The human element allows for real-time adjustments, nuanced strategies, and the ability to leverage years of market experience, making it a popular choice among institutional investors and those who prioritize precision and control.

On the other hand, low-touch trading leverages automation and advanced technology, offering a streamlined, cost-efficient solution. It minimizes human intervention, relying on algorithms to execute trades quickly and efficiently. This approach is ideal for traders who prefer speed, scalability, and reduced costs, particularly in high-volume, liquid markets. With the rise of sophisticated trading platforms, low-touch strategies have become more accessible, allowing even smaller traders to benefit from algorithmic precision without the need for constant monitoring. The question for traders, then, is not just about choosing between high-touch or low-touch strategies, but rather understanding when each is most advantageous. Finding the balance between personal interaction and automation can be the key to optimizing performance in an ever-evolving market landscape.

What is Low-touch and High-touch Trading?

Low-touch and high-touch trading are two contrasting methods used in financial markets, each with its unique set of processes and benefits. High-touch trading is characterized by significant human involvement, where brokers execute complex trades on behalf of clients, providing a personalized experience. This approach is ideal for illiquid securities or large orders requiring market expertise and discretion.

Low-touch and high-touch trading are two contrasting methods used in financial markets, each with its unique set of processes and benefits. High-touch trading is characterized by significant human involvement, where brokers execute complex trades on behalf of clients, providing a personalized experience. This approach is ideal for illiquid securities or large orders requiring market expertise and discretion.

Read More: What is a Private Trading Network? A Comprehensive Guide

On the other hand, low-touch trading uses automated systems such as electronic platforms and algorithms, minimizing the need for manual intervention. It is highly efficient for high-frequency trades, ensuring cost-effective and rapid execution, making it suitable for routine, high-volume transactions. Understanding these two approaches helps market participants optimize trading strategies based on their needs and market conditions.

The Evolution of High and Low-touch Trading

| Aspect | High-touch Trading | Low-touch Trading |

| Human Involvement | Significant – executed by brokers with personalized service | Minimal – relies heavily on algorithms and automation |

| Trade Complexity | Suitable for complex and illiquid trades | Suitable for high-volume, routine, and liquid trades |

| Speed | Slower due to human involvement | Faster due to automated systems |

| Cost | Higher – involves broker fees and manual processes | Lower – reduces transaction costs through automation |

| Flexibility | High – can adjust strategies based on evolving conditions | Limited – relies on predefined parameters |

| Relationship | Builds relationships with brokers for strategic guidance | No relationship aspect – purely algorithm-based |

Low-touch trading refers to trades executed using automated systems, such as algorithms or electronic trading platforms, with minimal human intervention. In recent years, low-touch trading has gained prominence, evolving with advancements in technology. Algorithmic trading tools and smart order routers have enabled faster execution with reduced transaction costs, making it especially popular for high-volume, low-complexity trades.

The evolution of low-touch trading has been driven by the necessity for efficiency and speed in executing high-frequency transactions. As markets have become increasingly data-driven, the capacity to leverage machine learning algorithms, automated systems, and artificial intelligence has transformed trading desks. Traders can manage hundreds of transactions simultaneously, responding instantly to changes in market conditions while reducing the costs of human involvement.

Key Features and Benefits of High and Low-touch Trading

Below are the combined key features and benefits of both high-touch and low-touch trading approaches, providing a holistic view of how these strategies complement each other in various scenarios:

Below are the combined key features and benefits of both high-touch and low-touch trading approaches, providing a holistic view of how these strategies complement each other in various scenarios:

1. Automation vs. Human Expertise

Low-touch trading provides significant automation, reducing the need for manual intervention. Trades can be executed quickly, allowing traders to focus on strategic decisions. On the other hand, high-touch trading offers human expertise, where brokers actively manage the trade to navigate complex market conditions.

2. Cost Efficiency and Personalized Service

Low-touch trading is more cost-efficient, reducing broker fees and minimizing manual handling expenses. High-touch trading, while costlier, offers a high level of personalized service, enabling tailored strategies to meet specific client needs.

3. Speed and Flexibility

Low-touch trading systems execute trades at high speed, suitable for high-frequency and routine trades. High-touch trading, however, offers more flexibility, as traders can adapt their strategies in response to evolving market conditions, especially for illiquid or large trades.

4. Transparency and Relationship Management

Low-touch trading ensures real-time transparency, with all transactions recorded for compliance and analysis. High-touch trading emphasizes relationship management, where brokers use their industry connections to offer clients strategic advice and insights that automated systems cannot replicate.

5. Risk Mitigation vs. Discretionary Judgment

Low-touch trading includes built-in risk mitigation tools to execute trades within predefined limits, minimizing emotional decision-making. High-touch trading, in contrast, leverages the broker’s discretionary judgment, allowing for nuanced decision-making that can be crucial during volatile market periods.

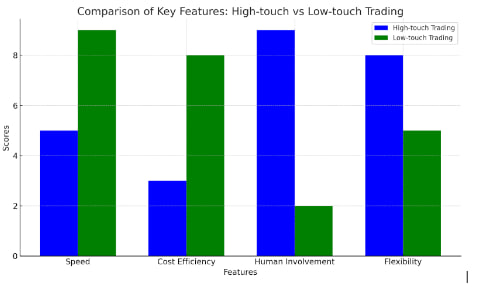

I have created a bar graph comparing the key features of high-touch and low-touch trading. The graph visually contrasts the aspects of speed, cost efficiency, human involvement, and flexibility between both approaches.

I have created a bar graph comparing the key features of high-touch and low-touch trading. The graph visually contrasts the aspects of speed, cost efficiency, human involvement, and flexibility between both approaches.

The Role of Algorithms in Low-touch Trading

Algorithms play a critical role in the success of low-touch trading by automating the decision-making and execution process, ensuring that trades are carried out efficiently and at optimal prices. Below is a breakdown of the main roles that algorithms fulfill in low-touch trading and how they contribute to better trading outcomes:

-

Determining Trade Parameters

Algorithms are at the heart of low-touch trading. They determine when, how, and at what price a trade should be executed. These algorithms can be tailored to meet specific requirements, such as minimizing market impact, optimizing trade timing, and reducing costs.

-

Smart Order Routing (SOR)

Smart order routing (SOR) algorithms help determine the best execution venues for orders based on liquidity, price, and other market conditions. SOR systems can scan multiple trading venues simultaneously, ensuring that the order gets filled at the best possible price.

-

Machine Learning Integration

Machine learning algorithms are increasingly being integrated into low-touch trading to improve efficiency. By learning from historical data, these algorithms can adapt to changing market conditions and fine-tune their trading strategies accordingly. The use of artificial intelligence and machine learning in low-touch trading has become an essential factor in staying ahead of market trends and gaining a competitive edge.

When to Use High-touch and Low-touch Trading

Choosing between high-touch and low-touch trading depends on various factors, including the nature of the trade and the investor’s strategy. Low-touch trading is suitable for routine trades, such as those involving high volumes of liquid assets. This method reduces costs, increases speed, and leverages automation to secure favorable market conditions. For trades that need quick and efficient execution without customization, low-touch is the ideal route.

High-touch trading, on the other hand, involves a greater level of human involvement, usually from a broker or a trader. It is preferred when dealing with illiquid securities, complex instruments, or when requiring a more bespoke approach. High-touch is essential when large institutional trades could impact the market. The trader’s skill in reading market sentiment and understanding nuances makes a big difference in executing such trades effectively.

Best Practices Low-touch Trading

Successful implementation of low-touch trading requires a strategic mix of technology, risk management, and data analysis. First, it is crucial to have cutting-edge algorithmic tools that are capable of analyzing large data sets. Risk assessment frameworks must be incorporated to ensure compliance and minimize operational risks. Integrating robust technology with adequate backtesting measures helps improve execution quality and ensures reliability. Additionally, efficient communication between brokers and trading desks is key to ensuring seamless trade execution.

Another best practice is to integrate real-time data analytics into the low-touch trading process. Real-time analytics provide traders with the information needed to make rapid decisions and ensure that the algorithms are functioning optimally. This not only improves the accuracy of trade execution but also helps identify any anomalies or issues that may arise during the process.

Challenges and Risks of Low-touch Trading

Low-touch trading, while highly efficient, presents several challenges and risks that must be understood and managed to ensure smooth execution. Below is a breakdown of the primary challenges and their implications:

1. Technological Failures

Technological failures are one of the biggest risks, where issues like network downtime or software bugs can result in delayed or incorrect executions. Such failures can impact the effectiveness of low-touch trading and lead to significant financial losses.

2. Lack of Discretionary Judgment

Low-touch trading systems can lack the discretionary judgment a human broker may bring in nuanced market situations. Automated systems operate strictly based on pre-set parameters and cannot adapt to sudden market changes that require human insight and expertise.

Read More: Top 17 List of Layer 1 Blockchains Every Crypto Enthusiast Should Know

3. Market Volatility

Automated systems operate based on pre-set parameters, and during times of extreme market volatility, these parameters may not adapt quickly enough. This can lead to significant losses if trades are executed at unfavorable prices, highlighting the need for effective risk mitigation.

4. Regulatory Challenges

Regulatory challenges must be considered, as compliance requirements can change rapidly, requiring updates to the trading algorithms and systems. Keeping up with these regulatory changes is crucial for avoiding penalties and ensuring smooth operation of low-touch systems.

Risk Management Strategies for Low-touch and High Trading

To mitigate the risks associated with low-touch trading, it is essential to implement effective risk management strategies. One approach is to establish strict monitoring protocols to ensure that the algorithms are performing as expected. Regular audits and performance assessments can help detect any potential issues before they lead to significant problems. Another strategy is to use kill-switch mechanisms that allow traders to manually intervene and stop trading activities in case of unexpected market events or technical failures.

Diversification of trading strategies is another key risk management tactic. By using a mix of algorithms designed for different market conditions, traders can reduce their exposure to any single point of failure. This helps in maintaining stability even during periods of high market volatility.

The Importance of High-touch and Low Trading

Despite advancements in technology, human expertise remains indispensable for high-touch trading. Market conditions can change rapidly, and human traders possess the ability to adapt, interpret market sentiment, and react to unexpected events. Unlike automated systems, human traders can factor in non-quantitative elements, such as geopolitical events or market rumors, which might affect asset prices.

Additionally, human expertise is essential for relationship management and building trust with clients. High-touch traders often serve as advisors, offering valuable insights and helping clients navigate complex financial situations. This personal touch is particularly important for clients who prefer direct interaction and value strategic guidance.

Conclusion

High-touch and low-touch trading represent two distinct strategies for executing financial transactions, each with its own advantages and limitations. While low-touch trading thrives on efficiency, automation, and low costs, high-touch trading emphasizes personalization, human expertise, and adaptability for more complex trades. As trading continues to evolve, blending the strengths of both approaches with innovative, bespoke solutions is likely the key to optimal trading outcomes in a dynamic market environment.

The future of trading will likely involve a hybrid approach that takes advantage of both automation and human expertise. By combining advanced technologies with strategic human intervention, trading desks can offer a more flexible and comprehensive service to meet the needs of a diverse clientele. Whether dealing with high-volume, low-complexity trades or complex transactions requiring a human touch, the right balance between low-touch and high-touch trading will ensure the best possible outcomes for investors.[/vc_column_text][/vc_column][/vc_row]