Private Trading Networks are gaining traction in the investment community as an alternative to both open exchanges and automated trading systems. They offer an intimate environment where traders can share strategies and insights without the noise and unpredictability of larger markets.

In this article, we will explore the concept of Private Trading Networks, how they work, and why they might be a better choice for those who value human intuition over automated processes. Read on to discover the benefits, components, and best practices for being a part of such a network.

What is a Private Trading Network?

A Private Trading Network is a group of traders or investors who collaborate in a closed, exclusive environment to share strategies, market insights, and opportunities. Unlike open exchanges or large-scale automated systems, these networks are typically small and built on personal relationships or trust-based connections. The main focus of a private trading network is often the pooling of resources, sharing of market information, and building a strong collective strategy to enhance overall success.

A Private Trading Network is a group of traders or investors who collaborate in a closed, exclusive environment to share strategies, market insights, and opportunities. Unlike open exchanges or large-scale automated systems, these networks are typically small and built on personal relationships or trust-based connections. The main focus of a private trading network is often the pooling of resources, sharing of market information, and building a strong collective strategy to enhance overall success.

In this kind of setup, members use private communication channels—like encrypted messaging services, invitation-only chat rooms, or secure forums—to exchange information about their trading tactics. The idea is to create a more intimate setting where participants can benefit from shared expertise and customized guidance, all without the noise and unpredictability of public trading environments.

Read More: High-Touch Trading: A Guide to Personalized Financial Transactions

How Private Trading Networks Work?

Private Trading Networks function by uniting a select number of investors or traders under one common objective. These traders connect through exclusive platforms or groups, typically organized by the network’s founder or a key facilitator. Communication is central to how these networks operate; participants discuss market developments, analyze trades in real-time, and offer each other valuable insights based on experience.

Private Trading Networks function by uniting a select number of investors or traders under one common objective. These traders connect through exclusive platforms or groups, typically organized by the network’s founder or a key facilitator. Communication is central to how these networks operate; participants discuss market developments, analyze trades in real-time, and offer each other valuable insights based on experience.

These networks often use private social media groups, encrypted chat applications, or even custom-built platforms to maintain security and privacy. Trust is the glue that holds these networks together—each member is vetted before joining to maintain the quality and integrity of information shared within the group. Traders coordinate their strategies, share insider tips, and collectively evaluate market conditions to make well-informed decisions. Some networks even share capital, allowing members to take on bigger positions than they could as individuals.

What Makes Private Trading Networks Better Than Automated Trading?

While automated trading systems are designed for speed and efficiency, private trading networks excel by offering something even the most advanced algorithms cannot: human intuition and adaptability. Automated trading bots rely on pre-set algorithms, and they can fall into traps during sudden market shifts. On the other hand, a private network brings together diverse perspectives—different members have their own expertise and market feel—allowing the group to adapt to volatile conditions more effectively.

While automated trading systems are designed for speed and efficiency, private trading networks excel by offering something even the most advanced algorithms cannot: human intuition and adaptability. Automated trading bots rely on pre-set algorithms, and they can fall into traps during sudden market shifts. On the other hand, a private network brings together diverse perspectives—different members have their own expertise and market feel—allowing the group to adapt to volatile conditions more effectively.

The human element is crucial here. Emotional intelligence and subjective decision-making can often outmatch the rigid logic of an automated program. A private trading network’s members can decide when to follow through on trades or when to pause based on their read of the broader market sentiment, something bots struggle with.

Benefits of Private Trading Networks

Private Trading Networks provide a range of unique benefits that enhance the trading experience and profitability for participants. Below are some of the key benefits of joining a Private Trading Network:

- Tailored Insights: In private trading networks, advice is more personalized. Members can discuss individual goals and strategies, helping each participant grow in a way that automated systems can’t accommodate.

- Higher Flexibility: Traders in these networks can be flexible, responding to market conditions that may not be covered by an algorithm. This adaptability often allows traders to respond to opportunities that automated systems might miss.

- Shared Experience: Traders in a private network bring different perspectives and expertise, which can help create a holistic trading strategy. The pooling of diverse experiences provides a broader understanding of market movements.

- Reduced Over-Reliance on Automation: Since members make their own decisions, there’s less risk of relying too much on automation, which may not always function well in unpredictable markets.

- Exclusive Opportunities: Traders may have access to private deals, pre-sale tokens, or other investment opportunities not available to the general public. Being in an exclusive group often means you’re among the first to hear about these chances.

Key Components of Private Trading Networks

Private Trading Networks are built upon several foundational components that facilitate their functionality and effectiveness. These elements ensure that the network operates smoothly and delivers value to all its members. Below are some of the key components:

1. Exclusive Membership

A Private Trading Network is typically invitation-only, with new members carefully vetted before they can join. This exclusivity ensures that the quality of insights shared remains high and trustworthy.

2. Real-Time Communication

Members use secure channels to communicate instantly, allowing them to share insights, tips, and strategies in real-time. This rapid exchange of information is crucial for staying ahead in the fast-paced world of trading.

3. Resource Pooling

Members may pool capital to increase their trading power, enabling the network to make larger trades that yield higher profits.

4. Risk Management

Risk is distributed across the network, as members collaborate and advise each other on minimizing potential losses. This collaborative risk management can be more effective than the rigid stop-loss settings in automated systems.

Differences Between Private Trading Networks and Automated Trading

Private Trading Networks and automated trading systems differ fundamentally in their approach and execution. Private networks emphasize collaboration, human insight, and adaptability, whereas automated systems rely on pre-set algorithms and rapid execution. Below, we break down the key differences that set these two approaches apart:

Challenges of Private Trading Networks

Despite their benefits, Private Trading Networks are not without challenges. Some of these include:

- Trust Issues: Since private trading networks depend heavily on trust, a breach can be highly detrimental. Members must rely on each other’s integrity, which can sometimes lead to conflicts or mistrust.

- Limited Membership: The exclusivity of these networks can also be a limitation. Finding the right people with the necessary expertise and trustworthiness can be challenging.

- Coordination Efforts: Ensuring that everyone is aligned and timely in their actions can be difficult. Unlike automated systems that execute trades instantly, the coordination required among network members can sometimes lead to missed opportunities.

Best Practices for Participating in a Private Trading Network

Participating in a Private Trading Network requires adhering to certain best practices to maximize the benefits while maintaining the integrity of the group. Here are some recommended guidelines to follow:

- Communicate Frequently: Open and regular communication is key. Make sure you’re always in sync with the other members to take advantage of opportunities.

- Be Trustworthy: Trust is foundational in private networks. Ensure you keep your word, respect others’ strategies, and uphold the group’s confidentiality.

- Stay Informed: Keep yourself updated with the latest market trends. The more knowledge you bring, the more valuable you become to the group.

Read Next: Program Trading: A Guide to Automated Market Strategies

Benefits of a Collective Approach

Private Trading Networks offer several collective benefits that arise from working as a group rather than trading alone. When individuals combine their strengths, the network becomes more resilient and capable of navigating complex market conditions. Below are some of the significant benefits of a collective approach:

- Strength in Numbers: Multiple people analyzing the market reduce the likelihood of blind spots. Members contribute different skills—technical analysis, fundamental analysis, and market sentiment—which together form a comprehensive market approach.

- Emotional Balance: Trading can be emotional, and making decisions based on fear or greed often leads to mistakes. In a private network, members can keep each other grounded, offering different viewpoints and emotional support during market highs and lows.

- Learning Opportunities: Less experienced traders benefit greatly by learning from seasoned veterans in the network. This mentorship element is absent in automated trading and even some public forums.

How to Get Started with Private Trading Networks

Getting started with Private Trading Networks involves more than simply joining an exclusive group. You need to be prepared, knowledgeable, and willing to contribute. Follow these steps to increase your chances of success:

- Research and Identify a Suitable Network: Look for networks that align with your trading goals, risk tolerance, and preferred style. Ensure that the network has experienced members who can genuinely contribute value.

- Build Your Reputation: If you wish to join an exclusive network, you often need to prove your skills and trustworthiness. Engage in discussions in public forums or social media groups to showcase your knowledge.

- Understand the Expectations: Each network will have its own rules and code of conduct. Make sure you understand what’s expected from members, from participation frequency to information sharing norms.

Risks to Be Aware of

While Private Trading Networks offer many advantages, they also come with certain risks that traders should be mindful of. Understanding these risks can help participants prepare and take necessary precautions to protect themselves and the network. Below are some of the key risks to consider:

Sharing information within a network involves some risk. It is crucial to ensure that communication channels are encrypted and secure to protect sensitive trading data. The risk of ‘groupthink’ is real, where members might conform to a dominant opinion within the network, which could lead to poor trading decisions. Maintaining independent judgment is essential while participating to avoid such pitfalls.

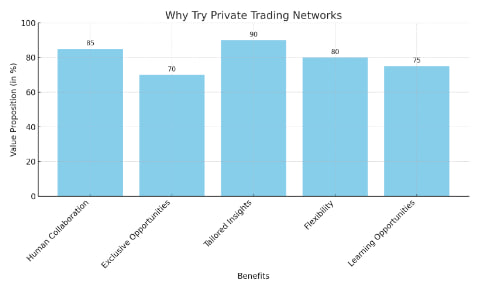

Why Try Private Trading Networks

Private Trading Networks offer several advantages that make them an attractive choice for traders seeking more control, collaboration, and exclusive opportunities. Below is a graph that visually represents the key benefits of joining a Private Trading Network, highlighting the value of human collaboration, exclusive opportunities, tailored insights, flexibility, and learning opportunities.

Graph Placeholder: “Why Try Private Trading Networks”

Graph Placeholder: “Why Try Private Trading Networks”

Here is a chart showing the membership growth of a Private Trading Network from 2018 to 2023. It highlights the increasing trend of members joining the network, reflecting growing interest and trust in this trading approach.

Conclusion

Private Trading Networks represent a hybrid approach between traditional human-led trading and fully automated systems. They combine the strengths of collective human judgment, adaptability, and flexibility, making them particularly attractive to those who value a personalized, collaborative approach. As markets grow increasingly complex and automated systems become more prevalent, the unique value proposition of private trading networks will likely continue to attract those who want more control over their trading decisions, without forgoing the support of a trusted community.

Whether you’re a seasoned trader or someone looking to grow your trading skills, a private trading network offers a distinctive environment where you can learn, grow, and profit—all while maintaining a human touch.